Investing for Retirement

Why save for retirement?

Because people are living longer. According to the U.S. Administration on Aging, persons reaching age 65 have an average life expectancy of an additional 19.2 years.* And since Social Security accounts for only about a third of total aggregate income for aged persons,** Social Security alone may not be enough to see you through your retirement years.

Keep in mind...

• A well-diversified portfolio can help balance risk

• The earlier you start investing, the more you can contribute over the course of your working lifetime

• By starting early, your investments will have a longer period of time to compound

• With a longer time frame, you will have a larger choice of investment possibilities

What to do...

• Assess your risk tolerance

• Determine your investing time frame

• Determine the amount of money you can invest

• Choose investments that are appropriate for your risk tolerance and time horizon

• Seek professional management, if necessary

What should I do if I determine that my income during retirement won’t be enough to meet my retirement expenses?

Answer:

Fortunately, you may have no need to despair. The further you are from retirement, the more time you have to resolve the expected shortfall. Even if you are closing in on retirement, there may be steps you can take to bridge the gap. In some cases, the best solution is to cut back current expenses and use that money toward retirement. This will enable you to put more money into your IRA, 401(k), and other retirement savings vehicles. Although you may not think you spend much on dining out and entertainment, such expenses really add up over time. Eliminating large purchases like boats and other luxury items will also make a big difference. Another way to save a bundle is to look into public colleges where your child can get a quality education for a fraction of what a private college costs. But you might be unwilling to make such sacrifices. If so, or if you simply can’t afford to save any more than you already are, consider investing more aggressively. Weight your portfolio more heavily toward stocks and growth mutual funds, and less toward fixed-income securities. A more aggressive investment portfolio exposes you to heightened volatility, but it may also provide a much greater return over the long run. The result: a potentially larger nest egg for you to draw on during retirement. Before investing in a mutual fund, carefully consider its investment objectives, risks, fees, and expenses, which are contained in the prospectus available from the fund. Review the prospectus carefully, including the discussion of fund classes and fees and how they apply to you.

Another alternative is to lower your planned expenses during retirement by setting more modest goals. Instead of buying that beach mansion on the Riviera, settle for a smaller house a few miles from the ocean. Similarly, instead of taking expensive trips around the world on a regular basis, travel closer to home and less often. The idea of a more frugal retirement lifestyle may not appeal to you, but financial reality may require it.

You can take a variety of other steps to make sure that retirement income will at least keep pace with retirement expenses. Some of the most common: work part-time during retirement or simply put off retiring until you’re in a better financial position. If you have any questions please contact my office, and I would be happy to assist and service all of your financial planning needs. Initial consultation is free of charge.

*Source: National Vital Statistics Report, Volume 61, Number 6, October, 2012

**Source: Fast Facts & Figures About Social Security, 2012, Social Security Administration

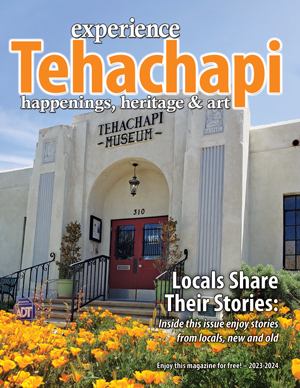

Please call me to find out more information, Jennifer Williams, President J. Williams Personal Financial Planning: 413 S. Curry St, Tehachapi, California Office Phone 661-822-7517 Office Email: jennifer.williams@npbfg.com Jennifer is a Registered Financial Consultant. She has over 20 years of experience in the industry.

Article is Courtesy of Forefiled, LLC