What about probate? (Part Two)

Ask the LDA

June 5, 2021

Probate is a legal proceeding that is used to wind up a person's legal and financial affairs after death. In California, probate proceedings are conducted in the Superior Court for the county in which the decedent lived, and can take at least eight months and sometimes as long as several years.

Only assets titled solely in the name of the decedent will be subject to probate. During probate the court must determine the validity of your will and/or your testamentary trust, supervise an inventory of all your real property and other assets, the payment of all your debts and taxes and then finally the distribution of your probate estate to the people you name in your will (or according to state law if you left no will, which is known as intestacy), or in a testamentary trust. This process may take many months or longer. It is also a matter of public record. This delay in settling an estate and making final distribution of assets to the heirs is unnecessary and comes at the worst possible time. An appropriately structured estate plan can help clients avoid this delay in the distribution of your estate.

Costs associated with probate

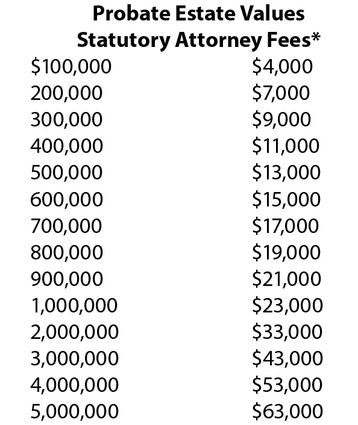

When property passes through full probate, your estate will incur attorney's fees, court costs, and potentially other expenses, all of which can be quite substantial depending on the size and nature of your estate. Attorney fees are generally set by state law (see below for the maximum statutory rates for California) and are usually based on the market value of the assets in the estate being probated, exclusive of any debts or loans associated with the asset. If you own real estate in California or your estate value is greater than $150,000, the fee schedule below would usually apply to your probate estate.

*Executor's fees, if any, appraisals and other expenses would be in addition to the amounts shown above.

Diana Wade is a Legal Document Assistant. She can be reached at (661) 821-0494 or dianapwade@att.net. Diana is not an attorney, she can only provide self-help services at your specific direction. Kern County LDA #185, ex 4/11/23.