Keeping cool: Investment strategy vs. reaction

Lance’s Thoughts

March 28, 2020

After losing ground in 2018, U.S. stocks had a banner year in 2019, with the S&P 500 gaining almost 29 percent — the highest annual increase since 2013.1 It’s too early to know how 2020 will turn out, but it’s been rocky so far, and you can count on market swings to challenge your patience as an investor.

The trend was steadily upward last year, but there were downturns along the way, including a single-day drop of almost 3 percent on Aug. 14. That plunge began with bad economic news from Germany and China that triggered a flight to the relative safety of U.S. Treasury securities, driving the yield on the 10-year Treasury note below the 2-year note for the first time since 2007. A yield curve inversion has been a reliable predictor of past recessions and spooked the stock market.2 By the following day, however, the market was back on the rise.3

It’s possible that a yield curve inversion may no longer be a precursor to a recession. Still, larger concerns about the economy are ongoing, and this incident illustrates the pitfalls of overreacting to economic news. If you were also spooked on Aug. 14, 2019, and sold some or all of your stock positions, you might have missed out on more than 13 percent equity market growth over the rest of the year.4

Tune out the noise

The media generates news 24 hours a day, seven days a week. You can check the market and access the news anywhere you carry a mobile device. This barrage of information might make you feel that you should buy or sell investments in response to the latest news, whether it’s a market drop or an unexpected geopolitical event. This is a natural response, but it’s not wise to react emotionally to market swings or to news that you think might affect the market.

Long-term commitment

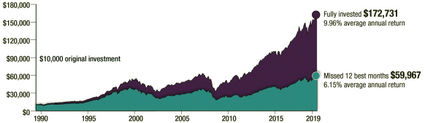

“Time in the market” is generally more effective than trying to time the market. An investor who remained fully invested in the U.S. stock market over the past 30 years would have received almost triple the return of an investor who missed the best 12 months of market performance.

Source: Refinitiv, 2020, S&P 500 Composite Total Return Index for the period 12/31/1989 to 12/31/2019. The S&P 500 is an unmanaged group of securities that is considered to be representative of the U.S. stock market in general. The performance of an unmanaged index is not indicative of the performance of any specific investment. Individuals cannot invest directly in an index. This hypothetical example is used for illustrative purposes only and does not consider the impact of taxes, investment fees or expenses. Rates of return will vary over time, particularly for long-term investments. Actual results will vary. Past performance does not guarantee future results.

Stay the course

Consider this advice from John Bogle, famed investor and mutual fund industry pioneer: “Stay the course. Regardless of what happens to the markets, stick to your investment program. Changing your strategy at the wrong time can be the single most devastating mistake you can make as an investor.”5

This doesn’t mean you should never buy or sell investments. However, the investments you buy and sell should be based on a sound strategy appropriate for your risk tolerance, financial goals and time frame. And a sound investment strategy should carry you through market ups and downs.

It can be tough to keep cool when you see the market dropping or to control your exuberance when you see it shooting upward. But overreacting to market movements or trying to “time the market” by guessing at future direction may create additional risk that could negatively affect your long-term portfolio performance.

All investments are subject to market fluctuation, risk, and loss of principal. When sold, investments may be worth more or less than their original cost. U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. If not held to maturity, they could be worth more or less than the original amount paid.

Sources:

1) S&P Dow Jones Indices, 2020

2) The Wall Street Journal, August 14, 2019

3-4) Yahoo! Finance (S&P 500 index for the period 8/14/2019 to 12/31/2019)

5) MarketWatch, June 6, 2017

Article courtesy of Forefield.

Securities offered through NPB Financial Group, LLC. A Registered Investment Advisor/Broker-Dealer Member FINRA, MSRB and SIPC.