It's time to think about taxes

Business Bitz

It's not tax season yet, but it is time to start thinking about your 2017 taxes. I always encourage my clients to sit down with their Tax Pro during the 4th quarter of the year. It's good time to see how you are doing and what adjustments need to be made. There are a lot of things you can do to minimize your tax liability, but you need to take action before the bell tolls at midnight on December 31st. (If you are on a calendar year) Also, take a look to see what changes have been made to the tax code. It is continually being updated and revised so often something you might think is cast in stone and you have been doing for years has changed and is no longer true. Don't be caught unaware!

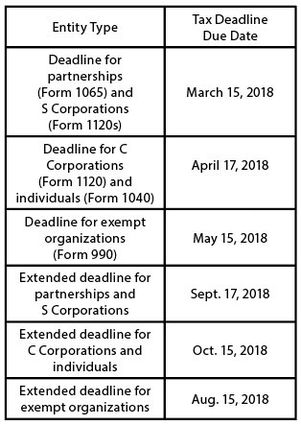

Be mindful of the due dates. Some of these have changed and people inadvertently filed late thinking they were on time. If you need more time to complete your return, don't hesitate to file an extension. You need to make sure any tax liability is paid on time, but the IRS is happy to give you more time to file your return.

For flow-through entities, the tax filing due date is the fifteenth day of the third month of the company's fiscal year. This makes the S Corporation, and an LLC tax return due date in 2018 fall on March 15 (for partnerships following a calendar year). The due date for flow-through entities on an extension will be September 17, 2018.

What if I started or closed a Business this year?

There are tax implications from starting or stopping a business.

If you started a business this year, know the date you began operating as a business and meet with your tax professional to see what is deductible. Often, most costs from before you started your business won't be deductible, but you can capitalize and deduct the costs over time.

If you quit operating as a business this tax year, be sure to know the exact date your business officially ended. You will want to account for all of the operational transactions made before the dissolution of your business. The only cash that should remain in your business account is the amount that you will distribute to backers as you liquidate and the amount you keep to pay your final taxes.

Whether you started or quit a business this year, you will need to file a short year return. You are responsible for filing taxes for the time you conducted business during the year. The short year return may apply to some seasonal businesses as well.

For most of us, it seems like the dust has barely settled from the 2017 filing of our 2016 taxes. What changes will affect 2017 taxes, filed in 2018? The changes in deductions and exemptions will ultimately impact how much money many individuals and families will see after filing this year's taxes.

Here are four things that might impact you:

1. Tax brackets

Tax brackets are adjusted annually for inflation. This year there is a small change in your favor. With inflation below the long-term average rate, the change should not have a big impact for most people. Those in the lowest bracket filing single will see an income increase of $50. At the top bracket, those listed as the head of household will see a $3,550 bracket increase.

2. Standard Deduction

You will see a slight increase in standard deductions when you file next year. For individuals and those filing as head of household, there is an increase of $50, which will put the standard 2017 deduction at, $6,350 and $9,350, respectively. For those couples that file jointly, the new $12,700 deduction is a $100 increase over the 2016 amount.

3. Medical Expense Exception for Seniors

Many seniors may feel the pinch as senior medical expense rules have changed. Taxpayers who itemize may claim a deduction for medical expenses over 10% of their adjusted gross income. Up until now, there has been an exception that applied to seniors permitting them to deduct medical expenses that add up to more than 7.5% of their AGI. Seniors filing in 2018 will be bumped up to the 10% threshold that applies to all taxpayers.

4. Roth IRA and Traditional IRA

A slight increase in the IRA phase-out means more people can take advantage of the tax benefits of investing in an IRA. For those using a traditional IRA, there is an increase of $1,000 for single taxpayers bringing the phase-out range from $62,000 to $72,000 and for married couples filing jointly to $99,000 to $119,000. The Roth IRA phase-out has increased by $1,000 for individual filers meaning that the phase-out will run from $118,000 to $133,000. For married couples filing jointly, the increase is $2,000. This brings the range to $186,000 to $196,000.

Even though the CSU Bakersfield Small Business Development Center doesn't give legal or tax advice, we will be hosting several workshops that will give you an overview of what you need to know or be mindful of concerning your taxes. Our goal is to give you the knowledge you need so that you can direct your professionals. If you are not already a client, go to http://www.csub.edu/sbdc to register or call our office at (661) 654-2856.

Jay Thompson is a Business Consultant with the CSU Bakersfield Small Business Development Center. The CSUB SBDC provides premium, one on one, no cost consulting to small business owners in Kern, Inyo and Mono Counties. For more information visit their website at http://www.csub.edu/sbdc.